Transfer of Wealth Opportunity Study

The Transfer of Wealth Opportunity Study details the re-investment potential to encourage economic vitality and community prosperity from our state's assets in the form of homes, businesses, or investments that will transfer between generations within the next 10 and 50 years. Learn more about the TOW Study.

Professional guidance for Community Foundations and their Partners

You've Come To The Right Place

If you are a Community Foundation in Illinois, we can help you learn and grow. If you are a professional advisor, we can help you understand the role of a Community Foundation as a partner to fulfill your clients' charitable goals.

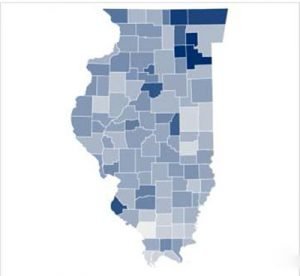

- With 35

Community Foundations across the state, there's a Community Foundation nearby to serve you

- Collectively,

the members Community Foundations of the Alliance steward over $3.3 billion in assets

- In addition,

In addition, member community foundation's gave out over $270 million in grants last year. And because most of our donor funds are endowed, we can grant that much annually...forever.

What can we do for you?

I am a...

Accountant

The tax implications of charitable giving are complex and changing - How can we help you maximize those benefits for your clients?

Attorney

Attorneys preparing wills and estate plans are natural partners with Community Foundations.

Community Foundation

See what services, learning, and networking opportunities come with your Alliance membership.

Donor

There are all sorts of ways to partner with your local Community Foundation to explore and implement your charitable goals.

10 Reasons to Give Through a Community Foundation

Local

Each Community Foundation is a local organization with deep roots in the community.

Broad expertise

Our professional staff has broad expertise regarding community issues and needs.

Personalized service

Each community foundation provides highly personalized service tailored to each individual’s charitable and financial interest.

Invest in causes

Our funds help people invest in the causes they care about most.

Asset variety

We accept a wide variety of assets, and can facilitate even the most complex forms of giving.

Professional advisors

We partner with professional advisors to create highly effective approaches to charitable giving.

Tax advantages

We offer maximum tax advantage for most gifts under federal law.

Multipy the impact

We multiply the impact of gift dollars by pooling them with other gifts and grants.

Experts in endowment

We build endowment funds that benefit the community forever and help create personal legacies.

Leadership

We are a community leader, convening agencies and coordinating resources to create positive change.